Ceilings And Roofs

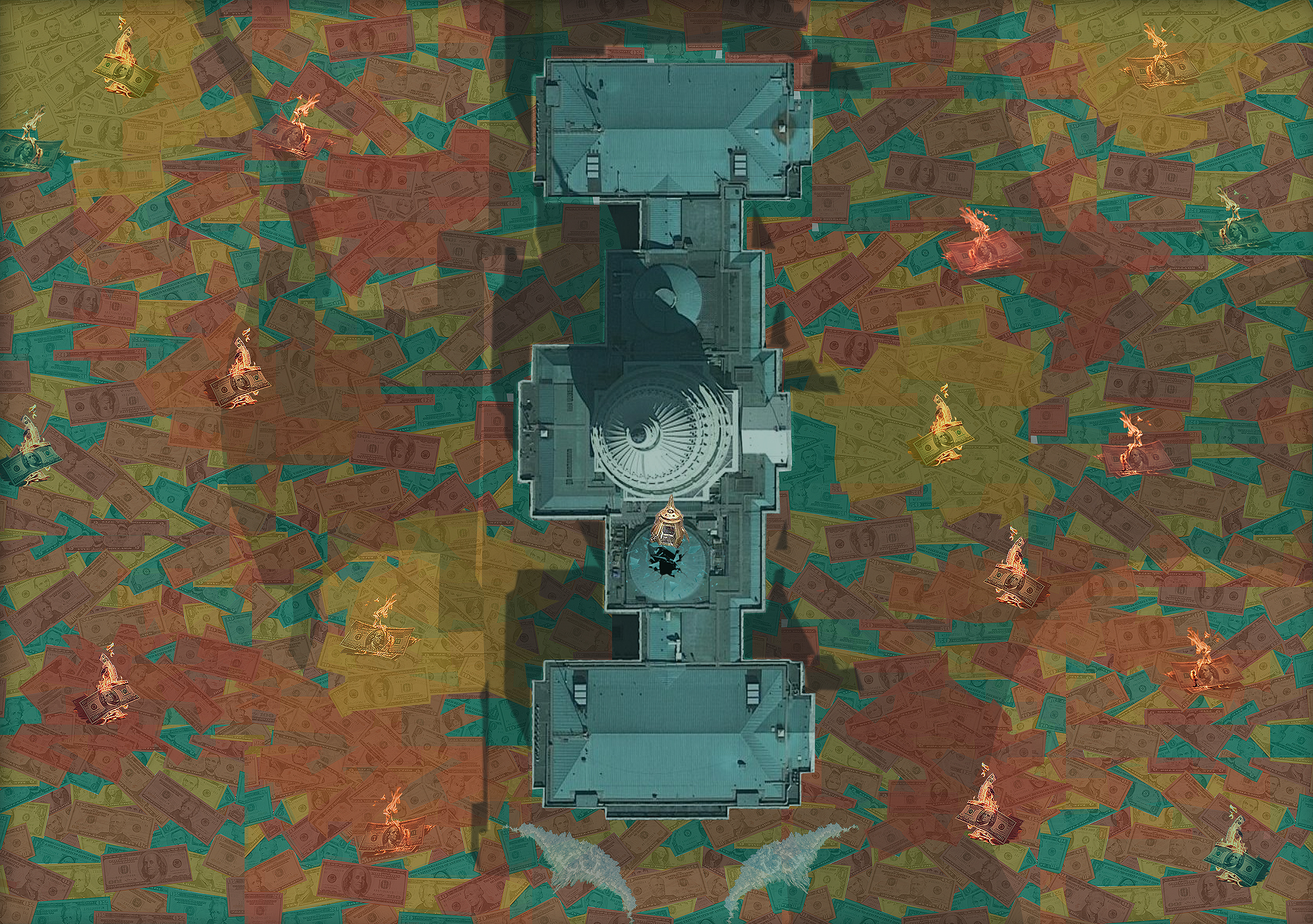

By Frank F Islam & Ed Crego, February 14, 2023 (Image credits: Tom de Boor, Adobe, Shutterstock, Google, et al)

By Frank F Islam & Ed Crego, February 14, 2023 (Image credits: Tom de Boor, Adobe, Shutterstock, Google, et al)

There has been much ado about many things in the nation’s Capitol as the country moves into the second month of this new year. One of those things is the debt ceiling.

Debt Ceiling Conversations

President Joe Biden and the new House Speaker Kevin McCarthy (R-CA) met in the White House for about hour on February 1 for a conversation to discuss the impasse that’s been created by the Republicans in the House, who are refusing to raise the ceiling. No resolution was reached.

After the meeting, Adam Cancryn of Politico reported McCarthy said “The president and I had a first good meeting — I shared my perspective with him, he shared his. No agreement, no promises, except that we would continue this conversation.” The White House released a statement saying that the meeting was ‘“a frank and open dialogue” and the first of many conversations.

President Biden initiated the second conversation in his State of the Union address on February 7. He did not speak with McCarthy alone, however. He spoke to the American public — and all of those gathered in the House Chamber for the address — about the debt ceiling conflict.

Biden was “frank and open” in his remarks. He stated that the “under the previous administration the American deficit went up four years in a row,” and that “nearly 25 percent of the entire national debt…was added under one administration alone, the last one.” These comments elicited boos from some Republican elected officials in the audience.

Biden proceeded to declare

“Some of my Republican friends want to take the economy hostage — I get it — unless I agree to their economic plans. All of you at home should know what those plans are.

Instead of making the wealthy pay their fair share, some Republicans, some Republicans want Medicare and Social Security to sunset, I’m not saying it’s the majority.”

These statements evoked jeers and taunts from some of the Republicans — including, as David Knowles of Yahoo News reports, Representative Margaret Taylor Greene (R-GA) calling Biden a liar. During this exchange, Biden went off script to say “Folks — so folks, as we all apparently agree, Social Security and Medicare is off the books now, right? They’re not to be — all right. We’ve got unanimity.”

As the testy “conversation” wound down, President Biden proclaimed, ‘So, tonight, let’s all agree — and we apparently are — let’s stand up for seniors. Stand up and show them we will not cut Social Security. We will not cut Medicare.” At the President’s request, both Democrats and Republicans stood up.

The elected officials standing together did not mean they will work together to resolve the debt ceiling debate. As Sarah Ferris and Katy O’Donnell reported for Politico, following the State of the Union address, Republicans in the House of Representative, such as Steve Scalise (R-LA) and Dusty Johnson (R-SD), accused the President of “spreading a false narrative” and “trying to score political points” on the Social Security and Medicare issues.

It is apparent from these initial conversations on the debt ceiling, and the reaction to them, that this standoff will go on for some time. Let’s examine what this means, and the potential implications for the U.S. and for us, beginning with why we are in this situation.

The Debt Ceiling Debate in Context

The Republican refusal to raise the ceiling was created by a small group of fringe right-wing Republicans, who held Kevin McCarthy’s prospects for becoming Speaker of the House hostage for five days and 15 ballots until he conceded to virtually all of their demands.

One of those demands was to not raise the debt ceiling unless there were cuts in the nation’s entitlement programs, such as Medicare and Social Security. Because of the concession made to that demand by now Speaker McCarthy, the leadership and most members of the Republican Party are committed to holding the United States and its citizens hostage as they attempt to get that done.

The US hit the debt ceiling of $31.4 trillion on January 19. This has led the federal government to perform all types of financial gymnastics in order to pay bills and cover expenses while there is an attempt to reach a compromise to lift the ceiling. There is no guarantee, however, that a compromise can be achieved.

The U.S. Department of the Treasury defines debt limit (aka “debt ceiling”) as follows:

The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations including Social Security and Medicare benefits, military salaries, interest on national debt, tax refunds, and other payments.

The Treasury Department clarifies:

The debt limit does not authorize new spending commitments. It simply allows the government to finance existing legal obligations that Congress and presidents of both parties have made in the past.

And goes on to state: “Failing to increase the debt limit would have catastrophic economic consequences. It would cause the government to default on its legal obligations — an unprecedented event in American history.”

The Treasury is correct that a default would be unprecedented. Would the economic consequences be “catastrophic”?

There was a potential of hitting the debt ceiling in 2021 because of a partisan standoff. At that time, Mark Zandi and Bernard Yanos of Moody Analytics put out a report titled “Playing a Dangerous Game with the Debt Limit.” Based upon his review of their report, Jeff Stein of the Washington Post noted that Zandi and Yanos concluded, “..a prolonged impasse over the debt ceiling would cost the U.S. economy up to 6 million jobs, wipe out as much as $15 trillion in household wealth, and send the unemployment rate surging to roughly 9 percent from around 5 percent.”

There were also significant debt ceiling debates in 2011 and 2013 when Barack Obama was President.

The 2011 debate concluded with a “complicated agreement,” with the Obama administration getting a debt ceiling increase of $2.4 trillion in return for comparable cuts and caps in spending for a 10-year period and a few related measures. (We provide insights into the nature of that debate in chapter two of our book, Working the Pivot Points: To Make America Work Again).

The 2013 debate included suspending the debt ceiling, a partial government shutdown near year’s end, reinstating the debt ceiling through a continuing resolution in early 2014, and a full reinstatement in 2015. (Molly E. Reynolds and Phillip A. Wallach provide an excellent summary of this jousting and the fiscal fights of the Obama administration in a piece for The Brookings Institution.)

Zandi and Yanos of Moody Analytics estimate that the 2011 and 2013 debt ceiling debates resulted in the U.S. economy losing as much as $180 billion and 1.2 million jobs by 2015. The bottom line is that partisan fighting over raising the debt ceiling would create enormous costs for the American economy and its citizens.

Given this, why in 2023 are we entering another ride on the debt ceiling merry-go-round? The Republicans in the House would assert that it is because of their conservative mindset and economic concerns. The evidence suggests, though, that it is more a matter of political posturing.

That evidence abounds. The most telling though is just to consider where the Republican Party stood in terms of its interest in dealing with the debt ceiling during former President Donald Trump’s term in office.

The national debt was nearly $19.9 trillion when Trump assumed the presidency on January 20, 2017. It went up to $ 26.9 trillion by the fiscal year ending on September 30, 2020 — an increase of $7 trillion. By the time Trump departed from office on January 20, 2021, the national debt was about $ 27.7 trillion — bringing the total during his tenure up to $7.8 trillion.

No matter which figure you use, the increase was substantial. But it didn’t matter to the Republicans. They stood on the sidelines and raised nary a whisper.

Today, in contrast, Speaker McCarthy, along with his MAGA allies, are raising their voices proclaiming the increase during the Biden years is unprecedented, and blaming the President and the Democrats for all of the most recent increases in the debt ceiling. This finger pointing is ironic. Because as Steve Rattner showed in his charts on Morning Joe on January 25, 2023, over the past several decades the debt ceiling has grown far more under Republican presidents than Democratic presidents, and the ratio of debt to GDP during the Biden presidency is the best that it has ever been during these years.

This is not to say that the national debt and budget deficits are not serious matters, nor that either political party is responsible for their existence. It is to say that the debt and deficits should be addressed and dealt with constructively in a bipartisan or nonpartisan manner.

Sadly, at this point, current confrontation regarding the debt ceiling does not appear to provide a sound basis for moving toward consensus, let alone compromise. It started on the right side of the political aisle in the House, with no support from the left side of the political aisle, so there is little chance of meeting in the middle.

Debt Ceiling Progress and Problem-Solving

This is why there was so much wailing and gnashing of teeth at the outset of this encounter. As this conflict progresses, there are some options available that the President might employ in order to bring the combatants together to try to find a meaningful shared path forward on the national debt and related issues.

They include:

- Embracing Section 4 of the 14th Amendment to the Constitution which begins as follows: “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion shall not be questioned.” Jamelle Bouie, opinion columnist of the New York Times advocates for this option in this column.

- Asking Congress to abolish the debt limit and reinstate the “Gephardt Rule” so that when new legislation adds to the federal deficit Congress automatically approves the borrowing needed to finance the new legislation. Leonard Burman and William G. Gale outline the need and logic for this approach in their article for the Brookings Institution.

- Having Treasury buy back previously issued government bonds that are now trading at a discount because interest rates have gone up. This option advanced by economist Dean Baker is discussed by Jeff Stein and Theodoric Meyer in their January 22 Washington Post article.

If one of these options or something else moves us toward constructive problem-solving, there is plenty of expert advice and prior experience to draw upon. Sometimes, you have to look backward to move forward.

In chapter 2 of Working the Pivot Points, we explain that much sound thinking and considerable time was invested in 2010 and 2011 in developing approaches to address the country’s deficit and debt crisis. Unfortunately, as we note in closing that chapter:

As 2011 drew to a close, the deficit and debt discussion had come full circle — if not to a full stop. The combatants had dug in their heels and there seemed to be little room for maneuvering or forward progress. Pure partisanship and politics were prevailing over policy-making and problem-solving.

There was a need to address the deficit and debt pivot point in a “fair and balanced” manner. Sound bipartisan solutions abounded. What was lacking at that time was not a lack of answers but a lack of will.

Will demands political and personal courage. It requires being able to see things from the other side of the aisle and putting country first. It requires both standing up for what you believe in and standing down those who will not compromise.

Fast forward a little more than one decade. The question becomes whether there is the will to confront the debt ceiling problem in 2023. We believe there are elected officials on Capitol Hill who have that will, and they can learn a lot by reviewing what was recommended in the past and consider what is being proposed today.

Accomplishing this requires setting biases aside and doing your homework. Peter Coy of the New York Times puts it this way:

Instead of plotting parliamentary maneuvers against one another, members of Congress should be talking about how to cut spending or raise taxes or accelerate economic growth — or realistically, do all three things — to slow the increase in debt as a share of gross domestic product. And the White House should eagerly participate.

In his article, Coy opines that the Republican Study Committee’s “Blueprint to Save America” might be the principal frame of reference the Republicans would use to balance the budget. He states that “On paper, the blueprint’s ability to reduce deficits is impressive. It has the federal budget moving into surplus in fiscal 2029, just six years from now.” He observes, however, “The problem, I think is whether the blueprint meets the two standards for realism, namely math and politics.”

After noting that the blueprint is unrealistic on both measures, Coy points out that it does not stand alone as a potential reference. As another source, he cites the Congressional Budget Office (CBO) paper, “Options for Reducing the Deficit 2023 to 2032,” issued in December 2022. The CBO paper provides 17 options for large reductions and 59 for smaller reductions. It also presents options related to raising revenue, via actions such as increasing individual income tax and imposing a new payroll tax.

Coy believes it is not possible to reduce the deficit through spending cuts alone and that we need to raise taxes as well. He ends his article by saying that political leaders should not engage in “brinkmanship.” They should, instead, have an authentic conversation about how to reduce the deficit.

As noted at the outset of this piece, the initial conversations have begun — whether it and subsequent ones will be “authentic” remains to be determined. Authenticity requires letting the other side know where you are coming from.

President Biden understands this, and that is why, in his State of the Union address, he said, “Next month when I offer my fiscal plan, I ask my Republican friends to lay down their plans as well. I really mean it.” Biden went on to assert that his plan would not “raise taxes on anyone making under $400 grand” and would require the “wealthy and big corporations to pay their fair share.”

Whether there are any tax increases or just spending cuts in the Republican plan will be revealed when their plan is unveiled. After that, time will tell whether the sharing of plans will produce a shared path forward on the debt ceiling or a plan-maggedon.

In our opinion, if there is a shared path plan, it should include more than spending cuts and tax increases. It should also include a strong focus on the current economic conditions — income inequality, inadequate health care, and increasing costs across the board — affecting tens of millions of Americans.

It should result in decisions that make our country a richer, not a poorer place, for the majority of Americans. It should result in raising the debt ceiling and the roofs of the working class rather than removing them.

Stay tuned to see whether these conversations take us there.